KEY POINTS

- BPSR and PenCom to integrate IPPIS with pension system for smooth disbursement.

- Pre-retirement training could help reduce post service mortality rates.

- The aim of integration is simplifying the manual processes and transparency.

The Bureau of Public Service Reforms (BPSR) and National Pension Commission (PenCom) are joining hands to integrate Nigeria’s pension management system with the Integrated Payroll and Personnel Information System (IPPIS) to help streamline pension disbursements and a smooth transition for retiring public servants.

BPSR announced this on Wednesday during a courtesy visit to PenCom in Abuja, where both agencies discussed pension reforms targeting gaps in administration.

Modernising pension management

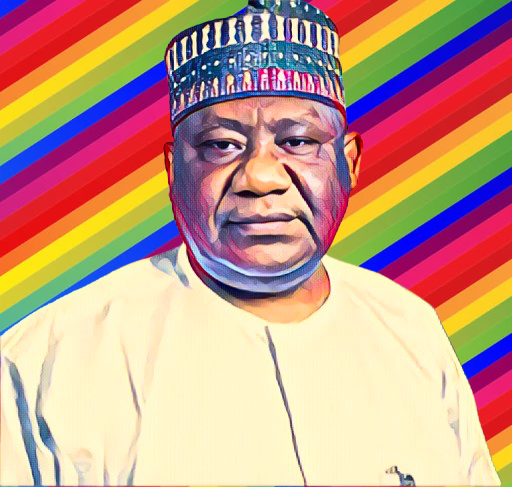

Reforms to help tackle challenges in pensions management, according to BPSR Director General, Dasuki Arabi.

Arabi explained that before the establishment of PenCom in 2004, ‘the pension system could not manage a sustainable defined benefits scheme, which resulted in delays and arrears.’

BPSR made it happen, he noted, by way of advocating to have the Contributory Pension Scheme adopted in its current form which sees employees and employers contributing towards sustaining the scheme.

Deepening integration with the IPPIS

PenCom Director-General Omolola Oloworaran emphasized the need for continuous reforms in the pension system, as facilitated by the integration of IPPIS within it.

“IPPS was developed to also ensure that when public servants retire, they will effortlessly pass from salary payments to pension payments through an automated process,” he said.

This integration would automate documentation and improve efficiency as well as transparency of pension disbursement, she said.

Pre-retirement training

He also said that more than 40 percent of public workers die shortly after leaving service.

“Starting four years before exit, we need to start pre-retirement training to get workers to plan their post service careers” “It gives them a roadmap, by the time they retire.”

Other efforts to modernise, and integrate, pension management include the integration of IPPIS with the pension system and enhanced preretirement training so that pensioners enjoy a smooth transition from service into the post service period.