Key points

-

Muazzam Mairawani plans $600 million cement plant in Kebbi.

-

New project will challenge Dangote Cement and BUA Cement.

-

MSM expands oil reserves while preparing $225 million U.S. IPO.

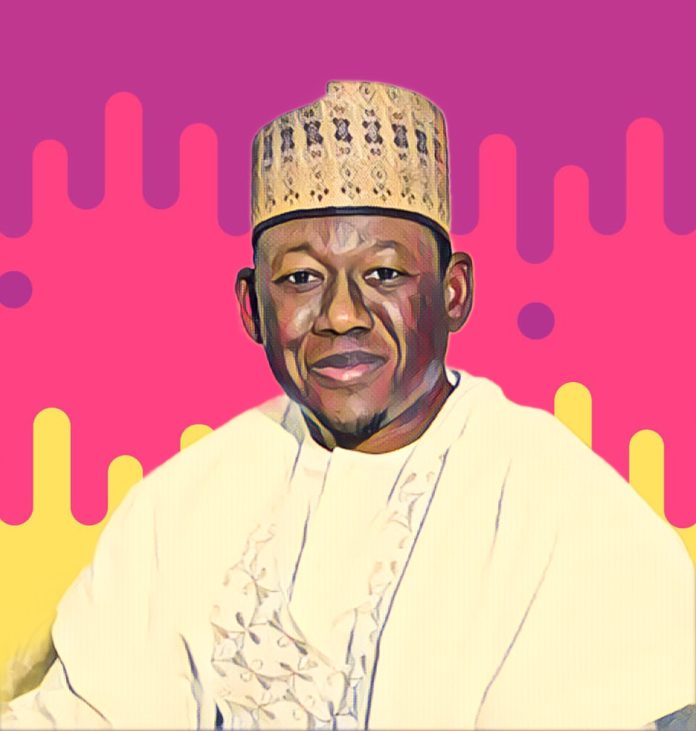

Nigerian billionaire Muazzam Mairawani has unveiled plans to build a $600 million cement plant in Kebbi State, setting up a direct challenge to industry giants Aliko Dangote and Abdul Samad Rabiu.

Mairawani, chairman of MSM Group, said the project will add 12 million tons of production capacity.

The factory is designed to compete in a market currently dominated by Dangote Cement Plc and BUA Cement Plc.

According to Forbes, Dangote’s wealth stands at $24.3 billion while Rabiu’s net worth is $7.2 billion.

Speaking at a press briefing in Abuja, Mairawani explained that the plant will be built in clusters.

Each cluster, he noted, is valued at about $600 million. He added that the investment will boost domestic supply, create jobs, and support Nigeria’s industrialization agenda.

IPO plans add global momentum

As reported by Billionaires.Africa, the cement project comes just days after Mairawani announced MSM Group’s plan to raise $225 million through an initial public offering in the United States.

The company will list 22.5 million units at $10 each on Nasdaq through its American arm, MSM Frontier Capital.

He said the IPO will fund investments in cement, oil and gas, shipping, and power. “We are targeting $2.7 billion every year in investments into Nigeria,” he said.

He credited President Bola Tinubu’s support for creating an enabling environment for expansion.

MSM expands oil and gas reserves

Founded in 2011, MSM Group began as a fertilizer supplier but has since expanded into logistics, cement haulage, fintech, shipping, and energy.

Under Mairawani’s leadership, the company doubled its oil reserves within six months.

Since acquiring Oil Mining Lease 98, reserves have grown from 118 million barrels to 244 million barrels.

“Our growth is driven by technical expertise and the experience of our team,” Mairawani said.

The company believes the IPO will strengthen its balance sheet and attract new capital for infrastructure and energy projects in Nigeria and abroad.