KEY POINTS

- Joshua earned a reported $92 million from the Miami fight

- US and UK taxes will claim about $66 million

- Location and residency sharply affect fighter earnings

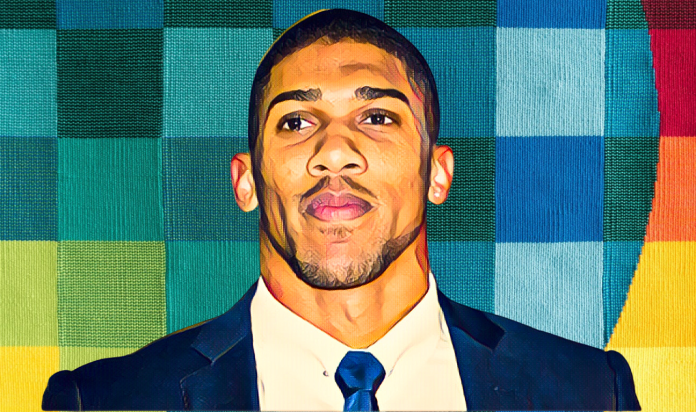

Anthony Joshua’s most lucrative night in the boxing ring has also produced one of the largest tax bills of his career, offering a reminder that blockbuster sports earnings rarely come without a heavy price.

Anthony Joshua earned a reported $92 million from his exhibition heavyweight bout against Jake Paul on Friday night in Miami.

The fight contributed to a $184 million prize pool, which promoters split evenly between the two fighters, giving Joshua the biggest single purse of his career.

Because the bout took place in the United States, tax authorities will deduct a significant portion of the money before it reaches his bank account.

A record purse meets US and UK taxes

US federal income tax will take roughly 37 percent of Joshua’s earnings, or about $52 million at the highest marginal rate. As a British resident, Joshua will also pay taxes in the UK once he declares the income.

In the United Kingdom, he will pay about $11.3 million to His Majesty’s Revenue and Customs and an estimated $2.8 million in National Insurance contributions, bringing his total tax burden to roughly $66 million.

Florida does not impose a state income tax, sparing Joshua an additional layer of deductions. Even so, after settling his federal and UK obligations, he will take home about $74 million from a total gross haul of roughly $140 million tied to the event and related income.

The fight itself ended quickly. Anthony Joshua dominated from the opening rounds and sealed the contest in the sixth with a clean right hand that stopped Paul, who had taken sustained punishment before the knockout.

How geography shapes fight earnings

While both fighters earned the same purse, their tax outcomes differ sharply. Because he is based in the United States, Paul will pay taxes only domestically, allowing him to retain a larger share of his winnings.

According to Billionaires Africa, the contrast highlights how residency and fight location can influence the final value of headline making bouts just as much as performance in the ring. Joshua’s earnings are taxed in the US and again in the UK, with National Insurance adding another cost.

The bout also arrives at a key moment in Joshua’s career. Earlier this year, he dropped off Forbes’ 2025 list of the world’s top 50 highest paid athletes. In 2024, he ranked 16th after earning about $83 million before taxes, fueled by wins in the ring and endorsement deals with global brands.