KEY POINTS

- Afreximbank gas infrastructure financing supports Levene’s equity investment.

- Deal gives Levene exposure to Nigeria’s regulated gas sector.

- Strategy shifts focus from trading to long term energy assets.

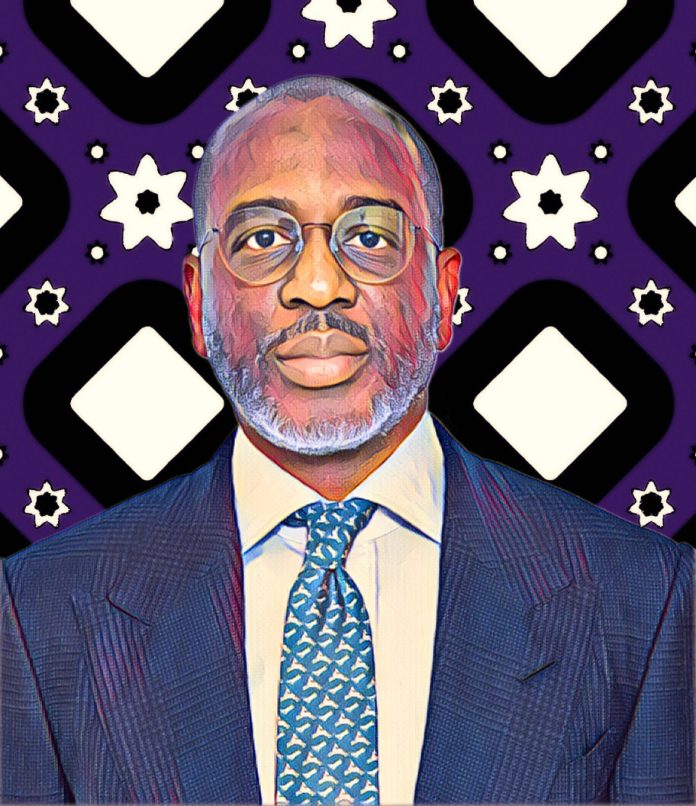

A $64 million facility from the African Export-Import Bank is helping Nigerian entrepreneur Nzan Ogbe reposition his energy company away from commodity trading and toward gas infrastructure, a segment increasingly viewed by investors as more stable and predictable.

Afreximbank said it has provided acquisition finance to Levene Energy Development Ltd. to support its equity commitment to Bluecore Gas Infraco Ltd., a special purpose vehicle pursuing an acquisition tied to a 30 percent stake in Axxela Ltd., one of West Africa’s largest gas and power infrastructure operators.

The transaction gives Levene direct exposure to Nigeria’s regulated midstream and downstream gas sectors, marking a strategic shift from a business built largely on trading crude oil and refined petroleum products.

Afreximbank gas infrastructure financing reshapes strategy

The lender said the Afreximbank gas infrastructure financing positions Levene to build recurring revenue linked to long life assets such as pipelines, gas distribution networks and gas to power projects. That contrasts with the volatility of trading businesses, which depend heavily on price cycles, access to supply and working capital.

Ogbe, Levene’s founder and chief executive, launched the company in 2016 after decades across commercial trading, real estate, telecommunications and oil and gas. In a 2023 interview with BusinessDay, he said Levene initially focused on exporting Nigerian crude and importing refined products before seeking opportunities across the broader energy value chain.

Levene now describes itself as an Africa born global energy company operating in trading, upstream services, engineering and clean energy development. Afreximbank said its relationship with the company began in 2019 through trade finance facilities that expanded as Levene’s operations grew.

Afreximbank’s financing for gas infrastructure aligns with the change

Afreximbank said that the Axxela linked arrangement was part of a larger plan to move away from fossil fuels and toward cleaner energy sources. They said that building more gas infrastructure can help with this. Nigeria holds Africa’s largest proven gas reserves but continues to face infrastructure gaps that constrain domestic utilisation.

According Billionaires Africa, Ogbe has also pushed Levene into renewables as banks tighten funding for new oil projects. In December 2025, Punch reported that Levene invested more than $20 million in a fully automated solar panel manufacturing facility and had begun exporting panels to Ghana and other West African markets.

As Nigeria’s gas value chain opens to new capital, deals such as this could reshape ownership of critical infrastructure. For Ogbe, the bet is that regulated gas assets will deliver steadier returns than trading margins long after oil price cycles turn.