Key Points

-

Power sector debt rises 62.5 percent to N6.5 trillion by end of 2025.

-

GenCos receive only about 35 percent of money owed for electricity supplied.

-

Experts warn debt will keep growing despite FG’s N1.23 trillion bond plan.

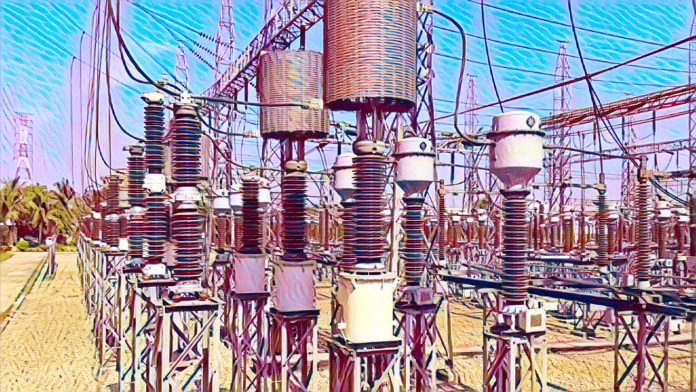

Nigeria’s electricity sector debt has grown fast. By the end of 2025, it reached N6.5 trillion. That is a 62.5 percent increase from about N4 trillion at the start of the year.

This sharp rise is now putting pressure on the Federal Government’s plan to clear the debt with a N1.23 trillion power sector bond.

Bond Plan Faces Doubts

In December 2025, the government started the bond plan with a first issue of N590 billion. The goal is to raise the full N1.23 trillion by early 2026 to improve cash flow in the power sector and keep electricity supply running.

Nigeria’s power sector has struggled for years because of heavy debts. These debts have scared investors away and slowed down upgrades to power plants and equipment.

Even now, the first bond issue has raised concerns. Power companies are worried about how the money will be managed and whether it will really fix the cash problems.

GenCos Paid Only A Fraction

Figures seen by Financial Vanguard show that power generation companies are still not being paid in full.

From May to October 2025, they received only about 35 percent of the money they billed for electricity sent to the national grid.

During those six months, 25 power companies billed N1.531 trillion. They were paid just N547.37 billion. The remaining N984.3 billion is meant to come from government subsidies, which have not been fully paid.

Each month followed the same pattern. In May, companies received just over 34 percent of what they billed. In June, it was about 35 percent.

July and August payments stayed around the same level. By September and October, payments were still below 37 percent.

The electricity regulator, NERC, said the low payments are due to government subsidy policy. Distribution companies are allowed to pay only what customer tariffs can cover.

The government is supposed to pay the rest as subsidies, but this has not happened fully.

In its third-quarter 2025 report, NERC said power distributors collected N570.25 billion from customers out of N706.61 billion billed.

That means they collected about 81 percent of the money. This was helped by moving more customers to the higher Band A tariff, even though power cuts remain common.

Subsidies And Payment Gaps Drive Debt

Power companies have also raised concerns about the N1.23 trillion bond itself. A report prepared for the Association of Power Generation Companies warned that the bond structure is risky.

It said the bond relies too much on government promises and lacks strong financial backing.

The report also questioned whether the issuing company is properly recognised and whether the funds meant to cover payment gaps really exist.

Consumer groups and experts say the real problem is unpaid subsidies. Chijoke James of the Electricity Consumers Association said the government must keep its promises, even though many consumers are unhappy with poor power supply.

Energy expert Yemi Oke said the subsidy system cannot continue like this. He warned that adding trillions of naira in unpaid electricity subsidies every year will hurt the economy.

Edu Okeke, head of Azura Power West Africa, said the issue is simple. Power companies are not being paid enough.

As long as they receive less than 40 percent of what they are owed, new investment will not come in, and the debt will keep growing, even with the bond.