KEY POINTS

- BlackRock assets under management climbed to $14 trillion in 2025.

- Record inflows of $698 billion drove earnings and dividend growth.

- BlackRock assets under management benefited from GIP integration.

BlackRock Inc. said assets under management climbed to $14 trillion, marking another milestone for the world’s largest asset manager two years after its $12.5 billion acquisition of Global Infrastructure Partners. The increase highlights the firm’s expanding scale as investors continue to channel money into global investment products.

The New York-based company, led by Chairman and Chief Executive Officer Larry Fink, reported the figures in its fourth-quarter earnings release. BlackRock posted a quarterly record of $342 billion in net inflows, pushing full-year inflows to $698 billion. Adjusted earnings per share rose to $13.16, beating analyst expectations of $12.44, while revenue increased to $7 billion, above consensus estimates.

The results underline sustained momentum across BlackRock’s platform as demand for exchange-traded funds, cash management and alternative assets continues to broaden.

BlackRock assets under management hit new high

For the full year 2025, BlackRock recorded adjusted earnings per share of $48.09 and a 19 percent jump in revenue to $24.22 billion. The board approved a 10 percent increase in the quarterly dividend to $5.73 a share and authorized the repurchase of up to 7 million shares, reflecting confidence in earnings durability and cash flows.

Exchange-traded funds remained a major growth driver. ETFs attracted $181 billion in net inflows during the fourth quarter and $527 billion for the year. The firm’s retail business added $82 billion in the quarter, while cash management products drew $74 billion as investors balanced liquidity needs with yield opportunities.

“BlackRock enters 2026 with accelerating activity across our platform,” Fink said, noting that clients entrusted the firm with nearly $700 billion of new assets in 2025, supporting 9 percent organic base fee growth.

BlackRock assets under management and GIP expansion

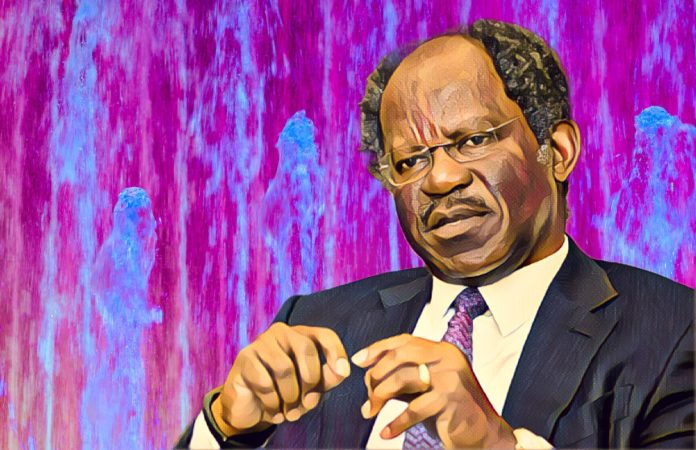

According to Billionaires Africa, the growth follows BlackRock’s integration of Global Infrastructure Partners, acquired in January 2024 to strengthen its infrastructure investing franchise. GIP, co-founded by Nigerian-born financier Adebayo Ogunlesi, manages more than $100 billion in assets across transport, energy and natural resources.

Ogunlesi, now a senior managing director at BlackRock, sits on the firm’s Global Executive Committee. In 2025, he also joined the board of OpenAI, which has secured tens of billions of dollars in funding and recently agreed to a multiyear cloud computing deal with Oracle valued at about $300 billion.

Separately, GIP is in advanced talks to acquire AES Corp., a U.S. power producer valued at roughly $40 billion, according to people familiar with the matter. The discussions reflect continued investor appetite for large-scale energy assets as utilities adapt to shifting power demand and decarbonization pressures.