KEY POINTS

- Senate approves borrowing N1.15 trillion from the domestic market for the 2025 budget.

- The loan’s goal is to fill in budget shortages and keep important projects going.

- Economists say that the cost of servicing debt is going up.

The Senate has approved President Bola Tinubu’s request for a fresh ₦1.15 trillion borrowing from the domestic debt market to help fund the 2025 budget deficit.

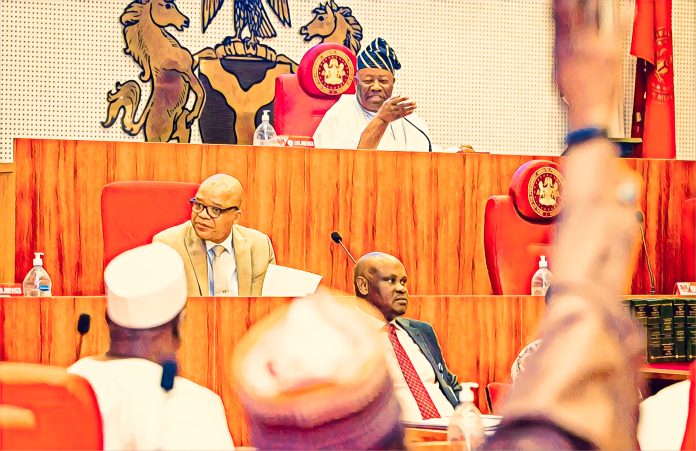

The approval came on Wednesday after consideration of the report from the Senate Committee on Local and Foreign Debts, chaired by Senator Aliyu Wamako of the APC, Sokoto North. The report was presented by the committee’s Vice Chairman, Senator Haruna Manu of the PDP, Taraba Central.

Manu said the request aligned with the government’s fiscal strategy to bridge funding gaps and ensure smooth execution of national projects under the 2025 fiscal plan.

Borrowing aims to bridge funding shortfalls

President Tinubu first made the request on November 4 through a letter read by Senate President Godswill Akpabio.

The letter said the borrowing aims to bridge the funding gap and ensure full implementation of government programmes and projects under the 2025 budget.

The Senate subsequently referred the proposal to Wamako’s committee for review. The committee’s report, delivered within the week, recommended approval of the borrowing, citing the need to sustain key national investments despite fiscal pressures.

The new loan is also part of the government’s larger effort to get more money from within Nigeria and less from other countries. This would further help keep Nigeria’s financial system liquid.

Experts think about how new debt may affect the budget

Analysts say that the N1.15 trillion in domestic borrowing will help keep spending going, but it might also put further pressure on the local bond market and raise the cost of repaying the debt.

Supporters of the plan, on the other hand, say that the borrowing fits with Tinubu’s strategy to tighten up the government’s finances and lets the government pay for important infrastructure and social programs without putting a lot of money at risk.

Finaly, the government insists the borrowing stays within permitted debt limits and plans to repay it in 2025 by improving tax collection.