Nigeria grapples with a shocking 26.72% inflation rate, a record peak in 18 years. This crisis has drawn intense backlash against the ruling party. The Peoples Democratic Party (PDP) and the Labour Party (LP) condemn the All Progressives Congress (APC). They point to the skyrocketing living costs now devastating Nigerians.

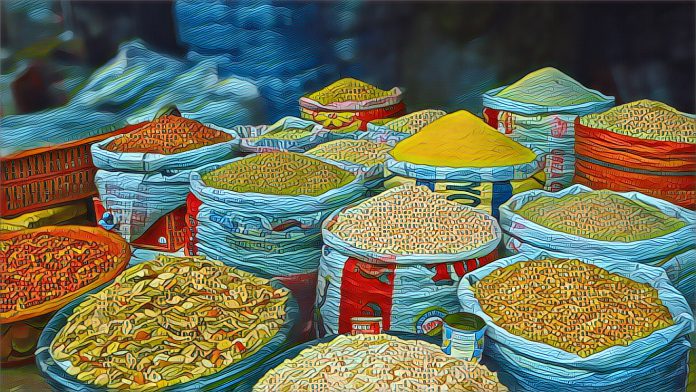

Recent data from the National Bureau of Statistics (NBS) highlights the crisis. Key goods like oil and cereals are becoming unaffordable. In contrast, the government and the APC remain silent, ignoring rising public frustration.

The Presidency avoids direct responses, redirecting questions to Finance Minister Wale Edun. Currently, Edun is unreachable, attending a summit in Morocco. The Labour Party took advantage of World Food Day, criticizing President Bola Tinubu’s failing economic policies.

According to a report by Vanguard, Peter Obi, from the LP, expresses concern over Nigerians’ struggle to afford basic food. Similarly, the PDP accuses President Tinubu and the APC of poor economic leadership. They emphasize the administration’s lack of strategic planning.

Repeated attempts to contact the APC’s Felix Morka were unsuccessful. Government insiders also refuse to comment, reflecting the administration’s aloofness on the escalating issue.

Inflation soared by 0.92 percentage points recently, the NBS reveals. This spike strains households further, diminishing purchasing power. Most alarming is the jump in food inflation, now at a harrowing 30.64%.

The opposition parties use these startling figures to critique the APC’s governance, underscoring its failure to shield citizens from economic hardship. Meanwhile, experts warn of tougher times ahead for everyday Nigerians. Factors include persistent currency depreciation and global oil market disruptions.

Lukman Otunuga, a financial analyst, suggests a bleak economic outlook. He warns of rising inflation and stricter monetary policies, destabilizing the economy. The Central Bank of Nigeria might increase interest rates again, a consecutive fifth time.

Now, calls for government intervention are loud and clear. Analysts advocate immediate action to address inflation causes. They recommend enhancing infrastructure, boosting agriculture, and revamping security to stabilize Nigeria’s economy.